To deal freely without any risk every trader needs to get maximum education related to indicators. To have a variety of stations dealing with the indicators you need not worry about your trading. But to operate them well different kinds of technical tools, you should be well educated in these terms because if you have less knowledge you won’t be able to get maximum benefits. So, most of the professional traders are in great danger while having less dealing through it. FOREX TRADING is always great to know.

Talking about Overbought And Oversold Indicator comprises of many features.

Let’s Discuss Them Below:

-It Is Highly Impressive As Well Easy To Reach To The Sky For Free.

-Tells About The Moves And Changes Related To Oversold And Overbought.

–It Is Basically Used To All Type Of Forex Currencies, Stocks And Cryptocurrencies.

-You Do Not Need To Upgrade It.

-It Is Most Appropriate For Meta Trader 4.

-The Rate Of Trading Can Be Improved By The Market Through Oversold And Overbought Indicator.

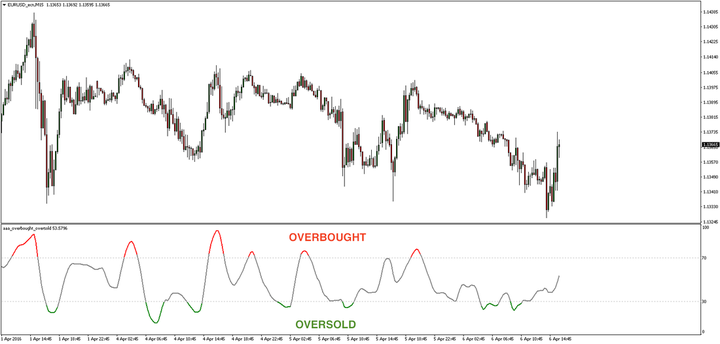

The indicator is mainly of two different ways that match it. They Are Relative Strenght Index (Rsi) And Stochastic Indicator. They have separate levels. As Relative Strenght Index Indicator Are Eighty Or Above Eighty It Is Overbought. Another Type Is Stochastic Indicator, So In This If The Level Is Round About Thirty Or Below Thirty, It Is Oversold. The most important part is that it has maximum and reasonable entries.

Relative Strenght Indes (Rsi) Ranges:

Every trend depends on two directions, an upward trend, and a downward trend. During the trend, RSI remains constant and firm. It remains above thirty and hit 70. When trend moves downward direction it rarely moves to seventy, so in this way, it hits downward direction so it rarely moves to seventy, so in this way it hits 30 or below thirty.

As we have discussed before the trends, if the trend remains for a long time on the other side, then the result of the relative strength index is zero. STOCHASTIC has few ranges whereas relative strength index can be calculated on average losses and gains. Both have strengths and weaknesses side by side. This is the best technical indicator.

Oversold And Overbought Indicator:

If the momentum of the price is above and constant it is overbought and if the momentum of the price is downwards so we can say it is oversold. The change in prices is not in a disciplined direction. OVERSOLD/OVERBOUGHT currencies vary by time.

Oversold/Overbought MT4 Indicator Free Download

Oversold/Overbought Indicator Download

Conclusion:

Winding up the article, the only way to be successful is to achieve knowledge. It is the best tool to build trading decisions. So traders need to be patient and cool-headed.